He looks like any other bearded young hipster. But 29-year-old Johnny Boufarhat is probably the youngest billionaire you have never heard of. The company he founded – a virtual events platform called Hopin – was at one point the fastest-growing European start-up of all time.

It turned Boufarhat, who lives in Switzerland after cashing in £100 million of shares in 2021, into a tech tycoon. But the firm’s meteoric rise now looks to be turning sour.

Hopin’s UK accounts for 2022 are now more than four months overdue at Companies House, The Mail on Sunday can reveal. Auditors at EY are yet to sign off the accounts due to delays.

It was all so different at the start. An Australian-𝐛𝐨𝐫𝐧 Brit, Boufarhat set up his business in 2019 after an auto-immune disease left him bedridden.

In February 2020 the firm had just six employees. But, in a piece of extraordinarily lucky timing for him, Hopin launched officially a few weeks later, just as Covid brought the world to a standstill. Investors were mad keen for businesses like Zoom – and indeed Hopin.

+2

Swiss watch: Johnny Boufarhat has now ditched Britain and taken his new-found riches to the land of low taxes

As Boufarhat put it, things ‘went crazy’. Cash-rich venture capitalists jumped at the chance to invest and the business was quickly valued at an astonishing £6.3 billion. Within 18 months the group claimed to have five million customers ranging from the United Nations and Nato to Dell and even rap star MC Hammer.

But the shine came off as the threat of Covid receded and many employees returned to their workplaces.

According to Hopin, the reason for the delayed accounts lies in its rapid expansion. A spokesman said it needed more time to work through the numbers, having acquired new businesses in 2021 and having raised money in multiple funding rounds.

The company says it is on track to file later this year. A spokesman added: ‘The company continues to operate with a positive cash flow.’

Hopin was forced to axe hundreds of jobs last year during rounds of lay-offs aimed at slashing costs.

Several senior executives left the company, including chief operating officer Wei Gao. She was brought in after 16 years at Amazon, but stayed less than 12 months at her new billet.

The exodus was in stark contrast to a hiring boom in 2021, when Boufarhat boasted that 80 per cent of his day job was spent recruiting new people.

His move to sell £100 million of shares coincided with him ditching Britain for Switzerland as he took his new-found riches to the land of low taxes – although a source close to him said his change in residency was not due to money.

+2

+2

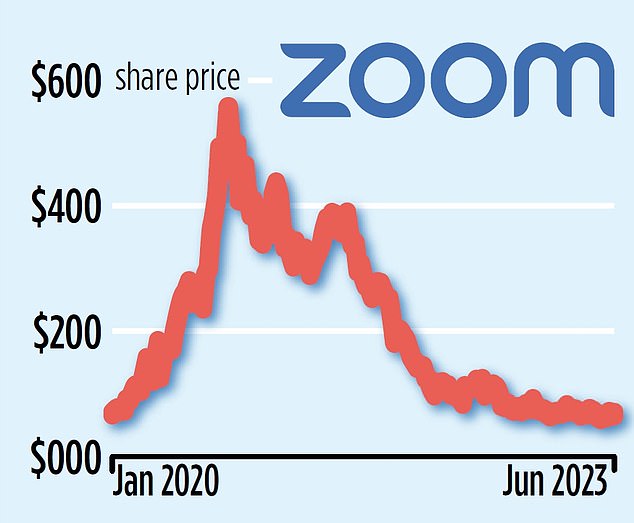

Zoom boom (and bust): Shares in Hopin’s rival surged during Covid but have since fallen to earth

Regardless of motive, the Manchester University graduate was recently reported by The Sunday Times Rich List to have a personal fortune of £1.7 billion, making him much wealthier than former Beatle Sir Paul McCartney.

While he has come a long way since launching Hopin from his bed, there is no ignoring its now-depleted valuation. Data platform, Beauhurst, has estimated it could have fallen as low as £661 million.

Francesco Perticarari, a London-based VC tech investor, said: ‘Hopin was always the product of hype.

Hopin off: Chief operating officer Wei Gao was brought in from Amazon but stayed for less than a year

‘As an investor, I was puzzled at how fast it grew. Stories like this should make us all think about what we want to back. I am not sure it will even survive.’

The scenario at Hopin – of a young founder who has accumulated huge personal wealth from a tech company that has seen its fortunes reverse – is one with a wider resonance. The Government is keen to plug the sector as one of the keys to the UK’s prosperity.

Rivals such as Zoom have also seen a significant drop-off in value. The US firm’s share price peaked at $599 in October 2020, but this has since plunged to below $70.

Boufarhat’s once-active Twitter account has not posted since last year.

He did, however, previously suggest a stock market listing in New York because of what he described as the ‘strong negativity’ surrounding the London market.

The rise and fall of Hopin is a cautionary tale which shows how tech firms valued in the billions can fail to live up to their hype.

It also raises questions about short-sighted investors who paved the way for Boufarhat’s staggering riches.

Hopin’s unofficial company motto was once hailed as ‘Let’s f***ing go’. The question now is, go where?